this post was submitted on 23 Apr 2024

970 points (98.1% liked)

Comic Strips

13471 readers

2770 users here now

Comic Strips is a community for those who love comic stories.

The rules are simple:

- The post can be a single image, an image gallery, or a link to a specific comic hosted on another site (the author's website, for instance).

- The comic must be a complete story.

- If it is an external link, it must be to a specific story, not to the root of the site.

- You may post comics from others or your own.

- If you are posting a comic of your own, a maximum of one per week is allowed (I know, your comics are great, but this rule helps avoid spam).

- The comic can be in any language, but if it's not in English, OP must include an English translation in the post's 'body' field (note: you don't need to select a specific language when posting a comic).

- Politeness.

- Adult content is not allowed. This community aims to be fun for people of all ages.

Web of links

- !linuxmemes@lemmy.world: "I use Arch btw"

- !memes@lemmy.world: memes (you don't say!)

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

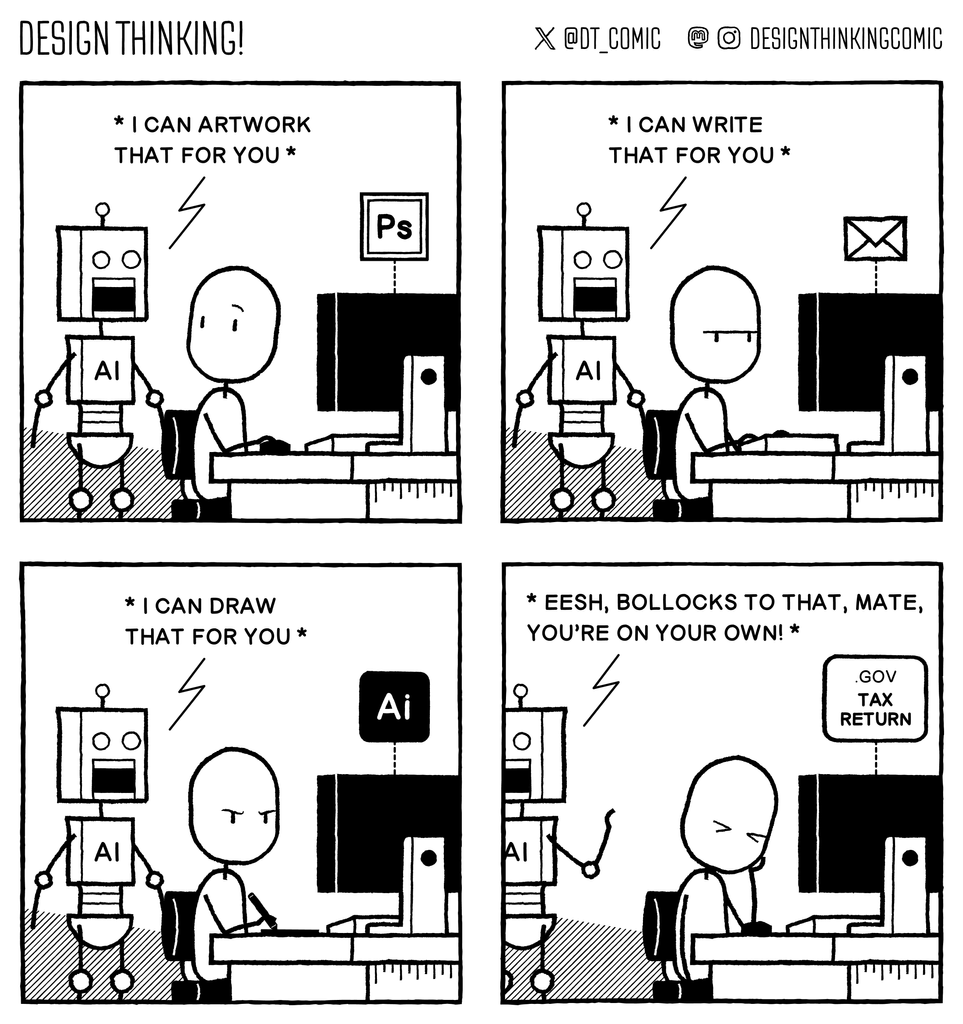

Have you actually done a large, nuanced return by hand. What does X mean? Where is X in this form? (cuz they don't use the same name). And do I need a Form 1234-56-A for that?

Like I understand what all of the concepts, but confirming and digesting the rules and paperwork is non trivial. Paying 300/hr for accountants to do it is even more painful.

No, I'm only 40 so I've never had to do a tax return by hand, I've always used a program.

Which is exactly what Intuit and TurboTax want.

Taxes should not require a third party to complete.

It should be the government saying, "Based on the information we have available, you owe $x. If you believe that is incorrect, please submit Form 1A."

Yep, I used the new federal website this year rather than h&r's free service.

If you can do a 1040ez I did them by hand regularly until I married an accountant’s daughter and it wasn’t bad

The 1040ez is even worse! Everything in the 1040ez the government already has on you!

1040 with a schedule A I get. If you have some sort of situation where you need to deduct medical debt or something like that, something the government wouldn't already have.

But 1040ez...literally is you just sending the government the info on your W-2.

That's it.

And if you get it wrong, straight to jail.

If you just messed up, the penalty is... paying the tax you should have originally. Or receiving the refund you should have originally.

It's only if you are actually committing fraud (which requires intent) that you go to jail.