this post was submitted on 11 Apr 2024

475 points (96.5% liked)

Memes

45635 readers

1391 users here now

Rules:

- Be civil and nice.

- Try not to excessively repost, as a rule of thumb, wait at least 2 months to do it if you have to.

founded 5 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

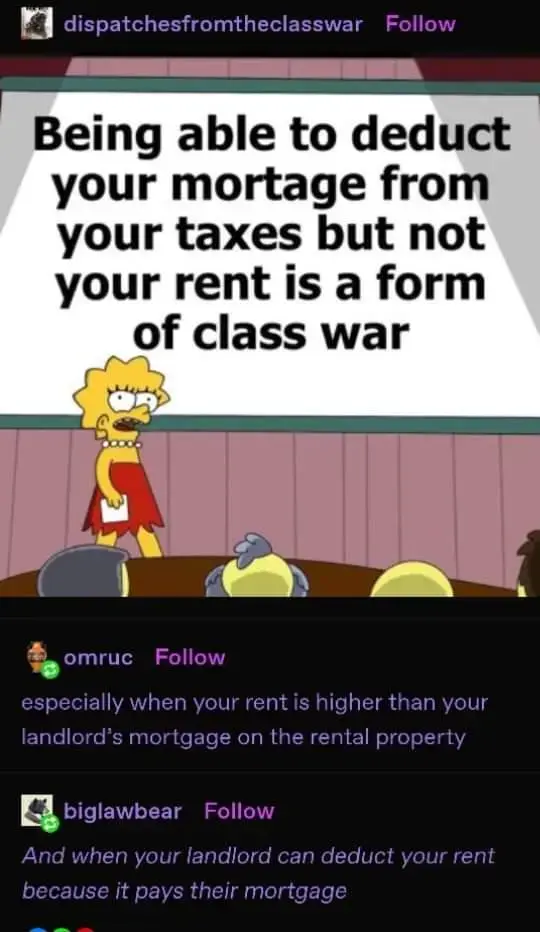

Another important thing to note is that you only benefit from this if you have so many itemized deductions that you can do better than the standard deduction. The mortgage interest alone isn't going to do that in a vast majority of cases. Since legislation in 2017, a lot of the tax advantage of owning a home was reduced.

The OP is wrong on every conceivable level.

Yeah. To break down why this meme is bad information, in simple terms:

Don't share or believe bad information.

Oops, sorry