InsanePeopleFacebook

Screenshots of people being insane on Facebook. Please censor names/pics of end users in screenshots. Please follow the rules of lemmy.world

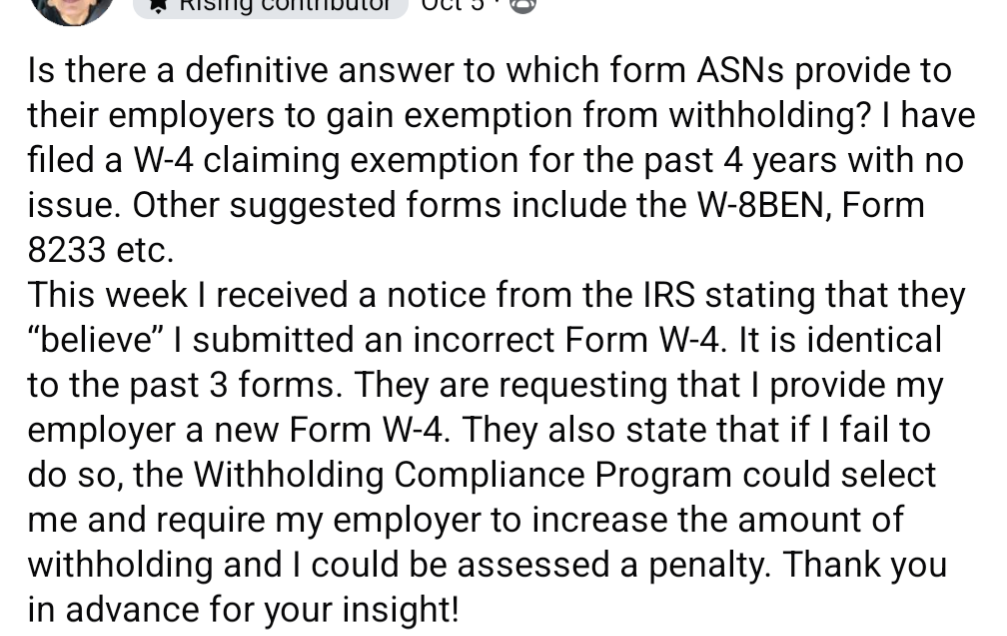

There is, in fact, a definitive answer!

That answer is: none of them.

You are welcome for my insight.

These posts make no sense. You don't need withholding. You tell your employer and that's it, the employer doesn't withhold. The IRS doesn't get involved at all.

You still need to pay taxes. If you owe a lot you may owe a penalty because you weren't paying a little with every paycheck.

Back when interest rates were high on bank accounts, I never did withholding. It paid to keep your money in the bank earning interest and pay quarterly taxes to avoid the penalty. Years later I had an accountant show me that I shouldn't even pay federal quarterly because the average money earned in the stock market was higher than the penalty for underpayment.

I enjoy that you think sovcits should make sense.

Or that they shouldn't be on heavy medication.