this post was submitted on 14 Jan 2024

664 points (98.3% liked)

People Twitter

5508 readers

1268 users here now

People tweeting stuff. We allow tweets from anyone.

RULES:

- Mark NSFW content.

- No doxxing people.

- Must be a pic of the tweet or similar. No direct links to the tweet.

- No bullying or international politcs

- Be excellent to each other.

- Provide an archived link to the tweet (or similar) being shown if it's a major figure or a politician.

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

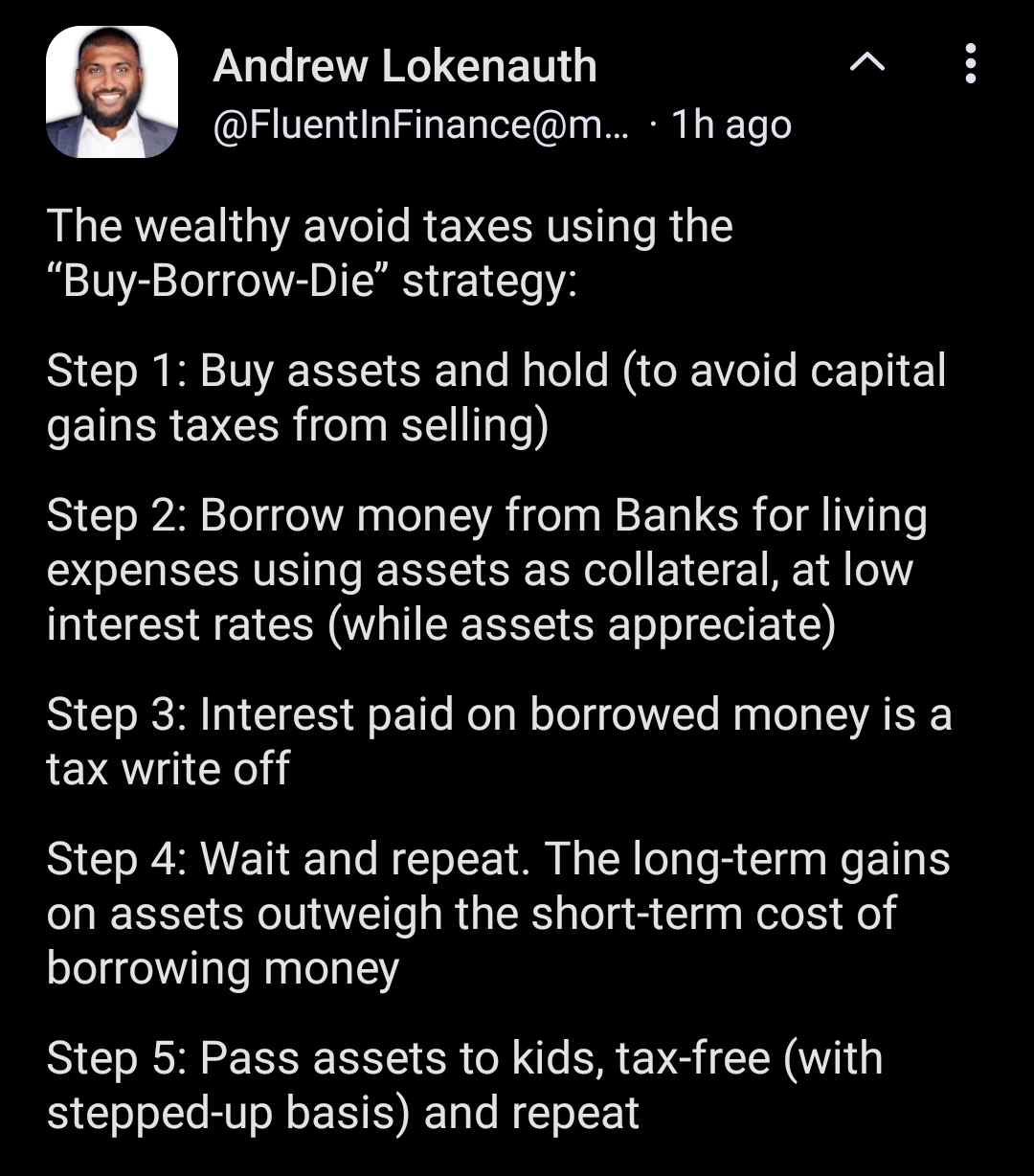

This is all good and well, until a 2008 happens. That's why strategies like this are only reliable if you have generational wealth to start with. You have to be able to withstand massive risk.

Massive is relative. If you have $1M and need $40k to live on (4% rule), a 50% downturn is massive. If you have $10M and need $100k to live on, a 50% downturn still leaves you plenty of room.

You don't need generational wealth, you just need a enough that the general "rule of thumb" is way more than you'd ever need to spend. That can be amassed in one generation.

I was thinking that too. Works as long as asset appreciation > interest.

We're in a higher interest rate world with a recession on the horizon, so this strategy may not work moving forward