this post was submitted on 17 Jul 2024

53 points (96.5% liked)

China

2032 readers

33 users here now

Discuss anything related to China.

Community Rules:

0: Taiwan, Xizang (Tibet), Xinjiang, and Hong Kong are all part of China.

1: Don't go off topic.

2: Be Comradely.

3: Don't spread misinformation or bigotry.

讨论中国的地方。

社区规则:

零、台湾、西藏、新疆、和香港都是中国的一部分。

一、不要跑题。

二、友善对待同志。

三、不要传播谣言或偏执思想。

founded 4 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

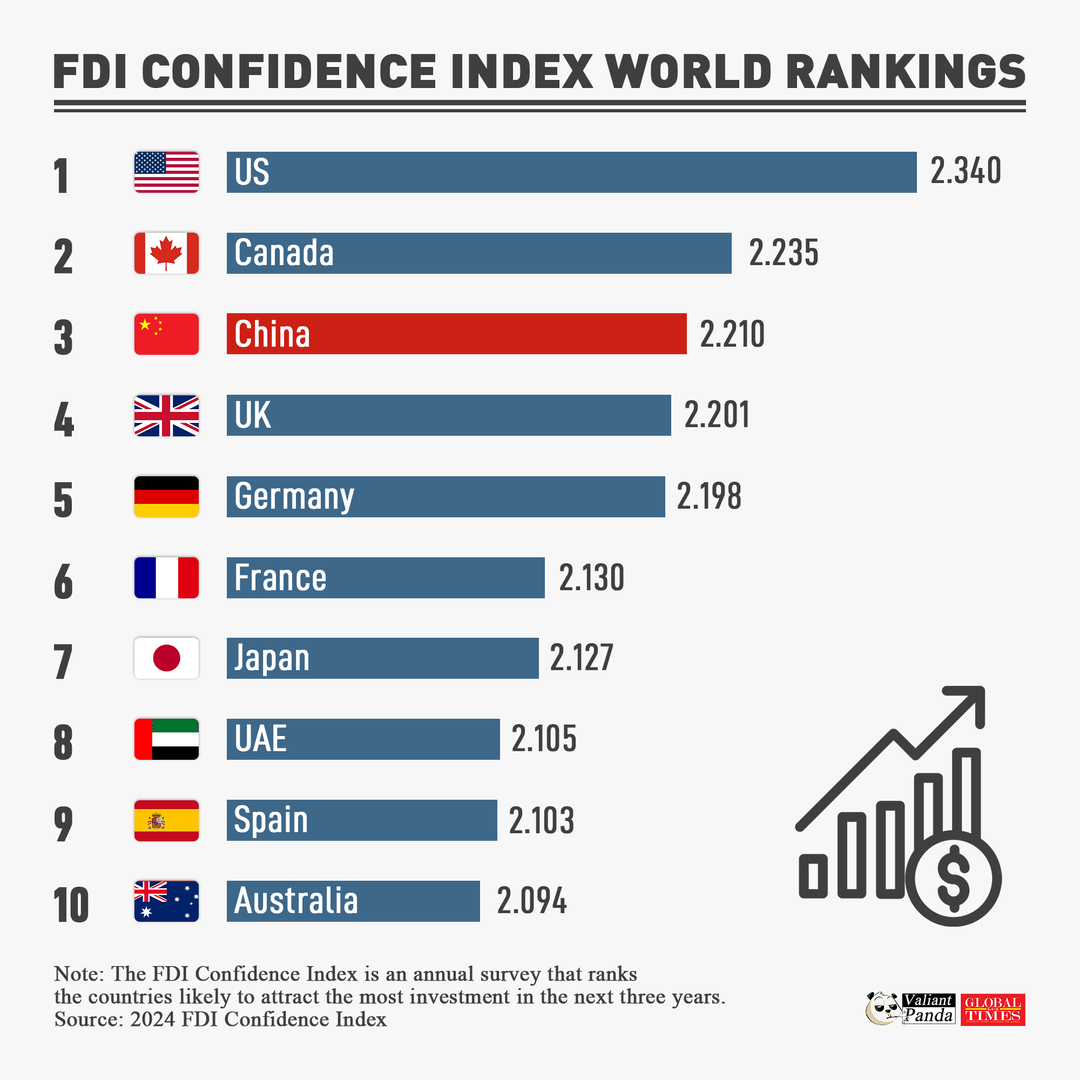

For this one, I think added context and understanding is necessary for anyone to get anything meaningful out of it.

As for what the added context and understanding is? Well, for starters, the US which holds first place, is also the inglorious home of the petrodollar/world's reserve currency (though this position is slipping away), has made its living for the past half century or so from exporting immense quantities of its debt in the form of said dollars, and pretty much all of that FDI likely goes to wholly unproductive sectors of the economy- speculation and rentier behavior (real estate and the stock exchange). Its currency is overvalued (and despite that it faces serious inflationary problems due to how atrocious its spending is), it is the home of multiple bubbles (like the aforementioned real estate and stock market) waiting to bust, and it features some absolutely abhorrent cartels and govt. sweethearts that are basically guaranteed a constant and ridiculous profit for some of the most overpriced and inefficient goods and services (when such things can even be argued to have been "delivered") in the world- the military-industrial complex, the entire farce that is the US higher educational system, and the US pharma/healthcare/insurance industries among the top offenders.

Second place is a particularly inglorious and unenviable spot, too. Canada, my home and (not) native land, is home to serious rentier and cartel behavior- and over 40% of new investments and capital growth to my understanding is from real estate. And similarly to the US- I guarantee, the bulk of it is speculation, not productive activity... not that our "productive activity" is particularly cost-effective either... Anyways, needless to say, this country's real estate bubble is perhaps one of, if not the most, atrocious and detached from reality out of the developed world. And the country's place on the rankings do not likely (remotely) affect the true wealth of this nation, and probably even by-and-large serves to worsen the material conditions of the bulk of those living here.

Similar, I assume, can be said about much of the rest of this list- the FDI is probably mostly not going to productive activity, and is likely generally centered around speculation and asset bubbles. Most notably, if anything the European countries on this list are outright deindustrializing by all appearancea- so where exactly is that FDI going to? Lol...

The exceptions, I presume, are of course- China (which is undergoing controlled demolition of its own real estate speculation problems), and maybe Japan and the UAE. In China's case in particular, I imagine a significant portion of that investment actually goes to productive activity (industrial and infrastructure development, primarily).

Great comment, that is much needed context, thank you!