this post was submitted on 18 Oct 2023

288 points (96.8% liked)

Personal Finance

3827 readers

2 users here now

Learn about budgeting, saving, getting out of debt, credit, investing, and retirement planning. Join our community, read the PF Wiki, and get on top of your finances!

Note: This community is not region centric, so if you are posting anything specific to a certain region, kindly specify that in the title (something like [USA], [EU], [AUS] etc.)

founded 1 year ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

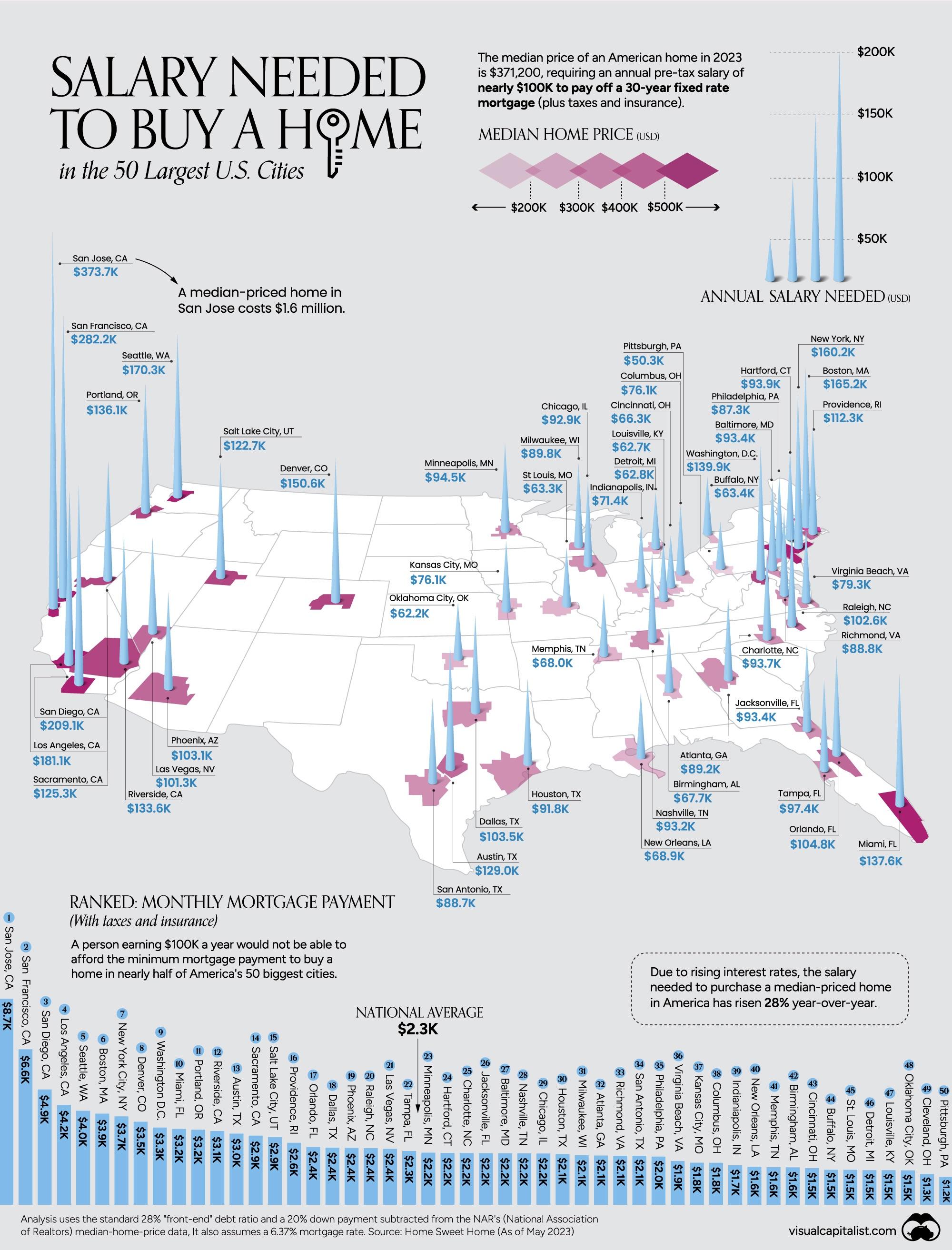

This is just not realistic.

Using the median home price is severely underestimating the cost of a decent home in an okay neighborhood.

With these salaries, you can afford a house that needs severe repairs or in either an unsafe or really inconvenient area.

I bought a house in one of these cities in 2017 with slightly more than what they say is the required salary. It was 195k with 4.5%. The school district reassessed the house from the sale, my taxes skyrocketed, and my mortgage increased $600 a month. I ended up selling the house after 3 years to move in my parents with 25k in credit card debt.

Today, that house would cost at least 300k and interest rates are around 8%. I’ve almost tripled my salary since then and my budget is probably max 330k.